WEC ENERGY GROUP (WEC)·Q4 2025 Earnings Summary

WEC Energy Delivers 8th Straight Beat, Reaffirms 7-8% Growth Outlook

February 5, 2026 · by Fintool AI Agent

WEC Energy Group reported Q4 2025 adjusted EPS of $1.42, extending its streak to eight consecutive quarterly beats. Full-year adjusted EPS rose 8.0% to $5.27, hitting the upper end of guidance. The company reaffirmed 2026 guidance of $5.51-$5.61 per share and raised its five-year capital plan to $37.5 billion, up $1 billion from the prior outlook. The long-term 7-8% EPS CAGR remains intact, with management expecting growth to accelerate to the upper half of the range (8%) starting in 2028 as more projects come into service.

Did WEC Energy Beat Earnings?

Yes — both EPS and revenue beat expectations.

*Consensus estimates from S&P Global

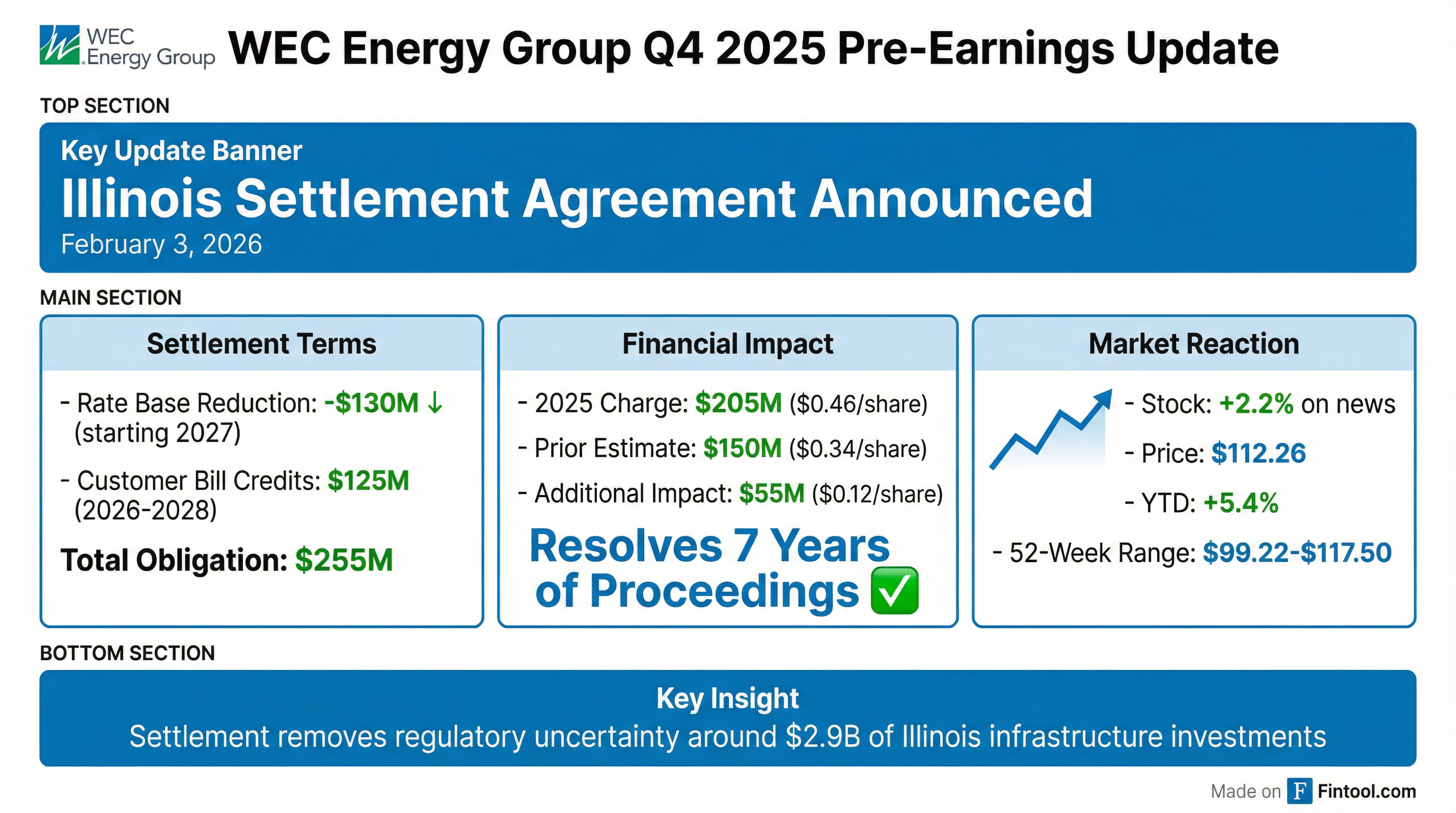

GAAP EPS of $0.97 includes a $0.45 per share charge from the Illinois settlement agreement reached with the Attorney General to resolve all open QIP and UEA rider proceedings. Excluding this one-time item, WEC's underlying operational performance remains strong.

Full-Year 2025 Results:

What Did Management Guide?

2026 guidance reaffirmed at $5.51-$5.61 per share, with Q1 2026 expected at $2.27-$2.37 (assuming normal weather).

Forward Consensus Estimates:

*Consensus estimates from S&P Global

The midpoint of WEC's 2026 guidance ($5.56) aligns closely with Street consensus of $5.59, suggesting no estimate revision risk.

How Did the Stock React?

Stock rose 1.6% in aftermarket trading following the release.

The stock has rebounded well from its November 2025 lows, with the Illinois settlement resolution removing a significant overhang.

What Changed From Last Quarter?

The biggest change this quarter is the resolution of Illinois regulatory uncertainty:

Operating Trends:

Retail electricity deliveries (excluding the iron ore mine) increased 2.2% for the full year, with residential use up 3.5%. Natural gas deliveries in Wisconsin rose 11.5%, though on a weather-normal basis they were 0.5% lower.

WEC's 8-Quarter EPS Beat Streak

WEC has delivered consistent execution, beating EPS estimates for eight consecutive quarters:

*Consensus estimates from S&P Global

Data Center Pipeline: 3.9 GW and Growing

WEC's hyperscaler pipeline expanded significantly this quarter, with total forecasted data center demand now at 3.9 GW through 2030.

Microsoft Update: Last week, Microsoft received local approval for 15 additional data center buildings north of Highway 11 ("Project North"), adding 500 MW to WEC's demand forecast and driving $1 billion of incremental capital spend. Microsoft referenced Wisconsin in its Community First AI Infrastructure Plan, pledging to "pay its share for electricity, minimize water use, and invest in the community."

Vantage Update: Broke ground in December on the initial 670-acre phase, with a planned $15 billion investment to complete by 2028. The site has potential to reach 3.5 GW over time.

Other Economic Development:

- Foxconn: $500M+ expansion of Racine County campus, adding 1,300+ jobs

- Rockwell Automation: New 1M+ sq ft manufacturing site in SE Wisconsin

- Uline: Continued land purchases for expansion

Key Management Quotes

"Across the company, I'm pleased to report that we delivered another year of solid results in virtually every meaningful measure, from customer satisfaction to financial performance, to steady execution of our capital plan."

— Scott Lauber, President and CEO

On Microsoft expansion:

"There's gonna be a lot to come as we start thinking about 2031 in the future also. And remember, there's still more land that they are looking to purchase and haven't developed yet. I think there's a lot of opportunities here."

— Scott Lauber, on analyst Q&A

On affordability and data center tariffs:

"Our very large customer tariff... is one of the best out there to make sure the data centers pay their fair share. We want true transparency."

— Scott Lauber, on VLC tariff

Q&A Highlights

On Microsoft upside beyond announced 500 MW: Analysts pressed for visibility on Microsoft's full buildout potential. Lauber noted Project North is "just the start" at ~570 acres with "at least another couple hundred [acres] they haven't developed" plus ongoing land purchases. He declined to get ahead of Microsoft's plans but called the opportunity "very positive."

On affordability concerns amid rate case filing: With Wisconsin's gubernatorial race bringing affordability into focus, Lauber emphasized cost discipline. WEC's fuel performance at Wisconsin Electric delivered ~$55 million in customer credits through positive fuel recovery and sharing mechanisms.

On VLC tariff settlement prospects: Management intends to go through the full regulatory process rather than settle, wanting "true transparency" and a thorough vetting of how data centers pay their share. Decision expected early May.

On potential to lower rates for other customers: As data center rate base grows (projected at 14-15% of earnings in the five-year plan), corporate allocations will spread across a larger base, providing incremental benefit to other customers over time.

On 2026-2027 growth vs 2028+: Management confirmed 6.5-7% growth in 2026-2027 accelerating to the "8 range" thereafter simply mirrors the capital plan timing as projects come into service.

Dividend: 23rd Consecutive Increase

On January 22, 2026, the board declared a quarterly dividend of $0.9525 per share, a 6.7% increase over the previous rate. This marks WEC's 23rd consecutive year of dividend increases, underscoring the company's commitment to shareholder returns.

Balance Sheet & Capital Allocation

WEC continues to invest heavily in infrastructure while maintaining balance sheet discipline:

Capital spending surged 58% year-over-year to $4.4 billion, reflecting accelerated investment in generation and grid infrastructure to support data center and electrification demand.

Generation Investment: $20B Over Five Years

WEC is investing heavily in generation to meet surging demand:

Projects Underway:

- Oak Creek: 5-unit, 1,100 MW combustion turbine project under construction

- Paris RICE: 7-unit generation site broke ground in Q4

- LNG Facility: 2 BCF storage facility broke ground in Q4

- Renewables: 7 generation projects + 2 battery storage facilities under construction

Point Beach PPA (Potential Upside): WEC's power purchase agreements with NextEra for Point Beach nuclear expire in 2030 and 2033. Management noted the contracts are priced around $120/MWh, suggesting new build generation could be more economic. CEO Lauber called this "potential upside in our plan" and said final decisions will be incorporated in the fall update.

Forward Catalysts

Key events and milestones to watch in 2026:

- Wisconsin Rate Case Filing: April 2026 for test years 2027-2028

- VLC Tariff Approval: Commission order expected early May; customers take service in June

- Illinois Rate Case: Filed January 2026 for test year 2027; decision expected by year-end

- Microsoft First Phase Online: Expected 2026

- Vantage First Facility: Could come online late 2026

- Point Beach Decision: Fall 2026 update on PPA replacement strategy

Key Takeaways

- Beat Streak Extends to 8 Quarters: Adjusted EPS of $1.42 topped consensus by 1.4%

- Capital Plan Raised to $37.5B: $1B increase from Microsoft expansion

- Data Center Demand Now 3.9 GW: Up 500 MW from Microsoft's "Project North" expansion

- Illinois Settlement Resolved: $130M rate base reduction + $125M customer credits removes regulatory overhang

- Growth Accelerating to 8% in 2028+: 7-8% CAGR with upper half expected as projects come online

- 2026 Electric Sales Growth 5.8%: Large C&I segment fueled by data center load